Analysis of HM Land Registry data shows resilience in the prime property market

Analysis of the latest price paid data from HM Land Registry1 shows that the percentage of prime properties sold in England & Wales when compared to the overall market hit a five-year high in 2022.

Analysis of the latest price paid data from HM Land Registry1 shows that the percentage of prime properties sold in England & Wales when compared to the overall market hit a five-year high in 2022.

Despite wider volatility in the housing market last year, the share of property sales in the prime bracket (properties sold for between £1m-£10m) grew to 3.9% of all sales in 2022. It has been gradually rising since accounting for 2.6% in 2019, 3.1% in 2020, and 3.3% in 2021. The highest value was seen in Q3 last year, at 4.2%.

According to the data1, the prime market has been particularly resilient in terms of sales volumes since Covid-19 first began in Q2 2020.

Despite shocks to the economy brought about by the pandemic, the data shows that the prime property market was relatively resilient, posting 1.3% growth year-on-year in 2020, compared to a 13% decline in the overall property market in 2019.

More broadly, while the number of property transactions has generally fallen across all properties – with an average of 5% fewer per quarter in the years since Covid-19 – for prime properties this proportion has risen by 23%. In real terms, this is the equivalent of 1,473 more prime property sales per quarter, compared to 11,653 fewer sales overall per quarter over the same timeframe.

Table One: Prime property as a proportion of total sales by value, 2018-2022

The dataset, which focuses on the paid values of properties as opposed to the estimated average value of the entire housing stock outlined in the Land Registry’s House Price Index, provides an accurate insight into the real value of properties across England and Wales over the past five years.

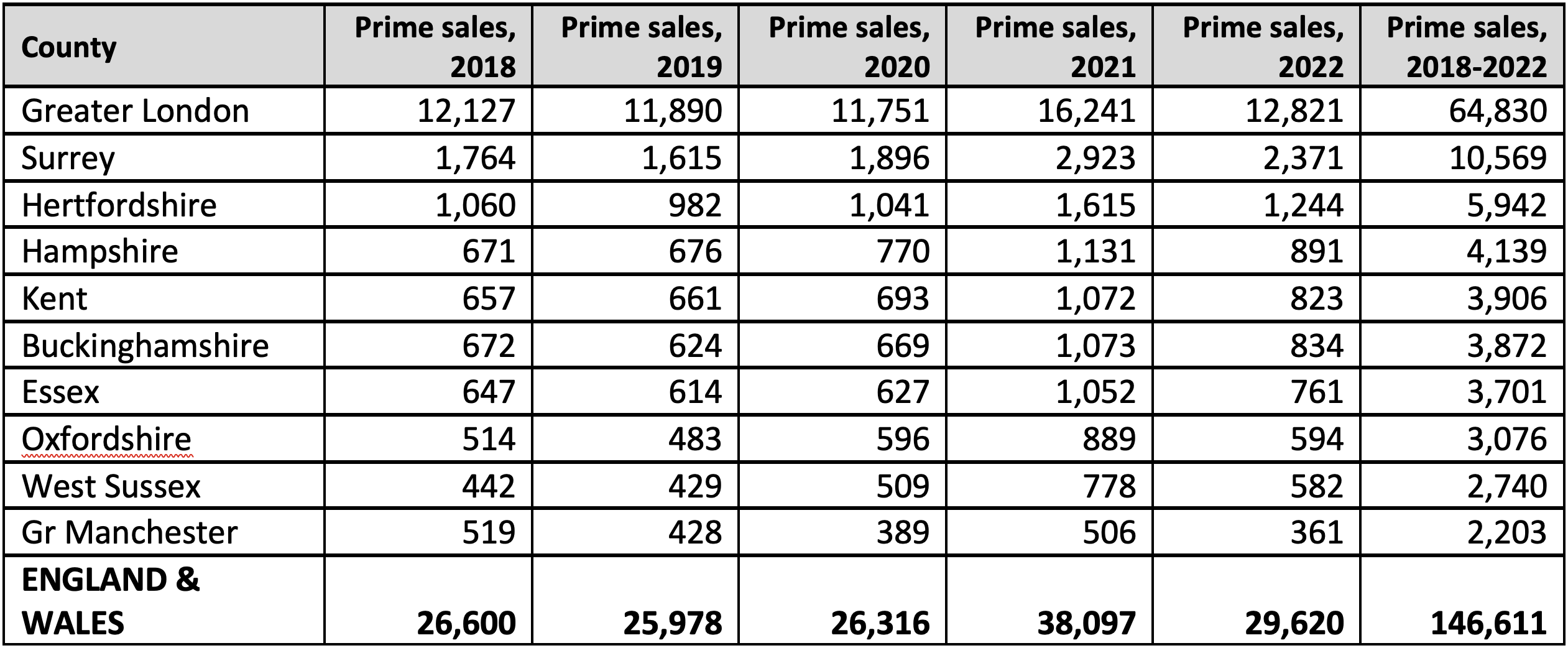

Over the past five years since 2018, more than 146,000 prime properties have been sold at a combined value of almost £298 billion, according to the analysis. The market remains dominated by sales in Greater London, with the region accounting for almost double the next nine authorities combined (see table below).

Table Two: Prime property sales by year and county, 2018-2022

Matt Dobson, Banking Director at Hampden & Co, said: “Our analysis shows that, despite a drop in overall property sales, demand for prime properties has remained strong. People seeking properties in this bracket are typically more confident navigating the market even as interest rates are rising. This means they are able to capitalise on opportunities as they arise and we expect to see this trend continue, particularly as supply increases to meet demand.”

1 Analysis of HM Land Registry’s Price Paid Data (PPD) covering the full year periods covering 2018 to 2022 in March 2023. Contains HM Land Registry data © Crown copyright and database right 2021. This data is licensed under the Open Government Licence v3.0.